Wildfire Damage Repair Los Angeles and Wind Damage Everywhere, Including Orange County

Wildfire damage repair in Los Angeles is essential for homeowners and businesses recovering from recent disasters. Along with powerful winds in Orange County causing roof damage, countless properties have been left devastated. Roofs torn off, charred structures, and families wondering how to begin rebuilding—if this is your reality, you’re not alone. There’s a clear path forward, and we’re here to help.

A Fire Weather Watch is in effect for Los Angeles and Ventura counties as Santa Ana winds bring critical fire conditions. Winds: Gusts between 30-50 mph, with mountain areas potentially reaching 60 mph. Humidity: Extremely low, around 10% or less. Stay vigilant, and monitor updates as conditions can escalate to a Red Flag Warning.

Step 1: Assess the Damage

Start by inspecting your property for visible damage:

• Wind Damage: Look for missing shingles, fallen debris, or structural cracks.

• Fire Damage: Identify areas affected by heat, smoke, or embers that may compromise your roof and home’s safety.

Not sure what to look for? Let a professional handle it. A comprehensive inspection ensures nothing is overlooked, giving you a full picture of what needs to be repaired.

Step 2: Navigate Insurance Claims

Dealing with insurance after a disaster is overwhelming. Many homeowners struggle with denials, delays, or low settlements. Our team can help by:

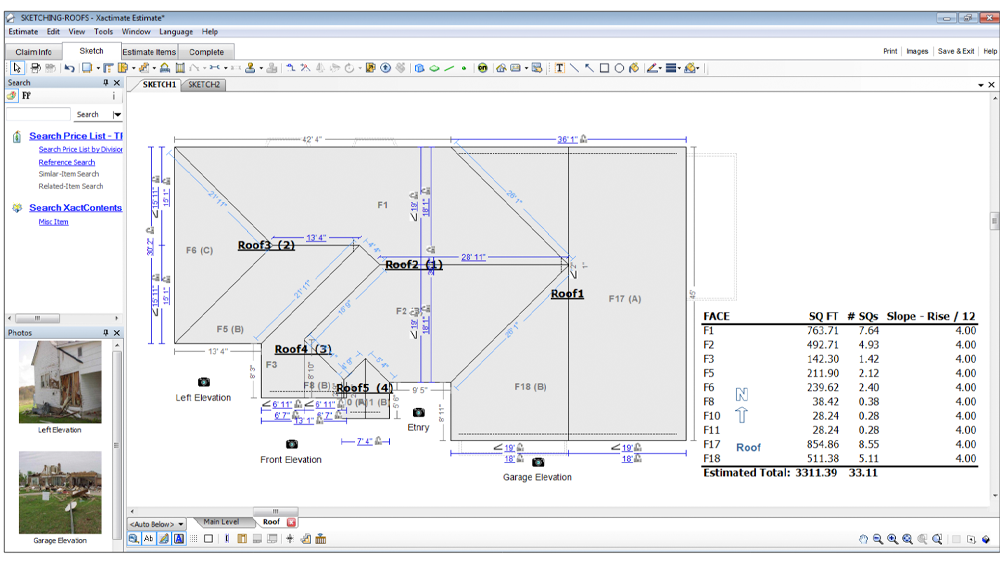

• Documenting all damage with photos and reports.

• Preparing detailed estimates that reflect fair market rates.

• Advocating on your behalf to secure the coverage you deserve.

Step 3: Begin the Rebuilding Process

Rebuilding after a disaster starts with trusted professionals. At All American Construction, we specialize in:

• Emergency Repairs: Securing your property with temporary fixes to prevent further damage.

• Full Restoration: From fire-damaged roofing to structural repairs, we handle it all.

• Windproofing and Fireproofing: Rebuild with stronger, safer materials to protect against future disasters.

Why Choose All American Construction?

With years of experience helping Los Angeles and Orange County homeowners recover from wildfires and high winds, we know what it takes to restore your property quickly and efficiently. We work directly with insurance companies to minimize stress and ensure you get the compensation you need to rebuild.

Take Action Now

Don’t let the chaos of disaster leave you paralyzed. Call All American Construction today for a free inspection and consultation. Or CONTACT US for any question. Together, we’ll assess your needs, handle your insurance, and start rebuilding your home—stronger than ever.

We’re Here to Help

Stay Safe: Protect Your Home and Loved Ones. Prepare now for changing conditions—secure your property and stay informed. We’re here to help every step of the way.”