WHAT IS AN INSURANCE CLAIM SCOPE OF LOSS?

An insurance claim scope of loss is a detailed description of the amount and type of damage that has been done to a structure; it includes the quantity and quality of materials and the current cost of those materials and labor that will be needed to repair that structure.

A scope of loss is typically more detailed than an estimate. A clear and complete insurance claim scope of loss helps a property owner get a fair, full and prompt insurance claim settlement and resist “lowballing”.

A scope of loss often includes photos, diagrams, and a detailed line item broken down by construction trades and materials. A complete scope of loss will specify the work that needs to be done to comply with the local building codes in the area.

DESCRIBING PRE-LOSS PROPERTY

Most insurance companies value a loss and make a settlement offer by preparing an estimate or a scope of loss. Usually the insurance company’s will send their own adjuster or a public adjuster to inspect the property and interview you. Insurance companies generally base their claim settlement offers on estimates or scopes of loss.

You – the insured – can prepare or hire a claim or construction professional to prepare your own scope, and then see how it measures up against the insurance company’s scope.

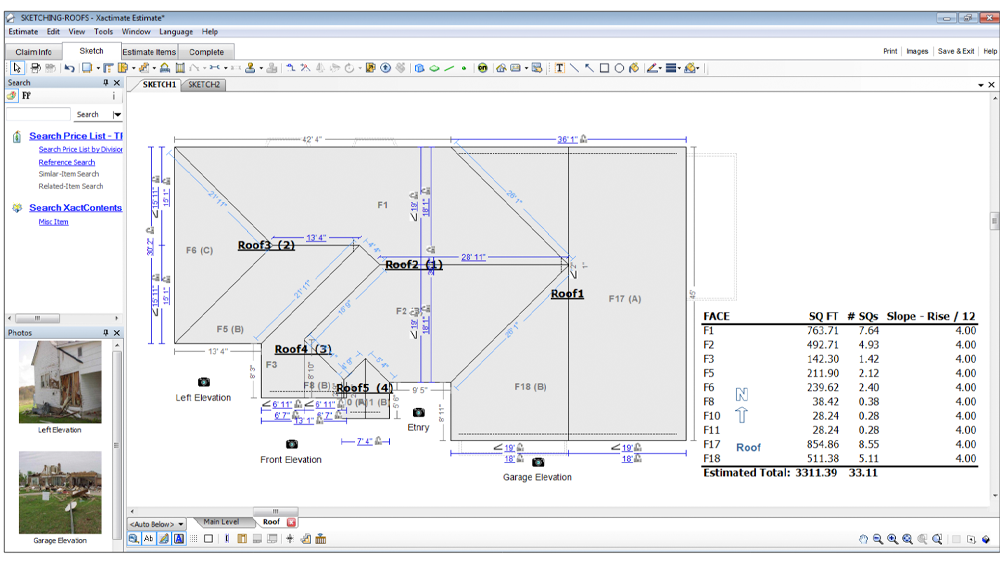

Nowadays, most adjusters use Xactimate to prepare their scopes, estimates and settlement offers.

Sometimes referred to as Scope of Repairs or Repair Scope, a Scope of Work is a document or multiple documents that describe structural damage for a Xactimate estimate.

It will detail what’s needed to repair the damages.

In short, a Scope of Work details the various types of work needed for a project.

On average, a Scope of Work will include:

- A floor plan or the dimensions of the damaged structure

- Photos of damages

- A description of the damage

- The number of damaged items

- A list of repair tasks

- An estimate of labor hours needed for repairs

The point of creating a Scope of Work and submitting it is to have it converted into an estimate.

This is so that you can gauge what the total cost will be for the project.

WHY IS SCOPE OF LOSS SO IMPORTANT?

After investigating your property, your insurance company will make a settlement offer for repairing your home. They will base this offer on a scope of loss, estimate, or loss evaluation. A lot of the time the insurance companies scope of loss is incomplete and inaccurate.

The more detail you provide about your pre-loss home, the more accurate that offer should be. But lowballing on claims is fairly common, so you need to be pro-active to nail down the true costs of returning your home to its pre-loss condition.

WHAT IS LOWBALLING?

“Lowballing” happens when the insurance company’s offer of what they will pay to repair your home is less than what it will actually cost you to repair or replace the existing property or items.

You should have a contractor who has enough expertise to evaluate whether the scope of work/materials and the cost assigned to those items in the insurance company’s offer is accurate.

The best way to know if you’re being “lowballed” by an insurance company is by having a scope of loss prepared by an independent third party such as All American Construction.

Schedule Your Free Consultation

Our project specialist will call you to get the details of your project. They’ll answer all your questions and help you select the products that are right for your project and your budget.

WHO CAN PREPARE AN INDEPENDENT SCOPE OF LOSS?

An experienced contractor familiar will the insurance claims process, like AAC Construction, can assist you in preparing a scope of loss. Alternatively, you can choose an independent consultant, construction estimator, or a public adjuster to help you prepare a scope of loss, usually for a fee. An independent scope is key to getting a fair insurance settlement.

Advantages of using an independent scope of loss

- Helps you negotiate better with the insurance company

- Contains a greater level of detail about the scope of work to be performed and its associated costs.

- Becomes harder for the insurance company to underpay the claim.

- More likely to be formatted similarly to the insurance company’s scope of loss, allowing for “apples to apples” comparison of the work and costs estimated by the insurer and the insured.

QUESTIONS TO ASK BEFORE HIRING A CONTRACTOR TO PREPARE AN INDEPENDENT SCOPE OF LOSS:

1. Have you previously prepared an independent scope of loss?

2. Are you familiar with local construction costs in my area? If so, how?

5. How much will you charge for preparing a scope of loss and what is included?

7. Ask for references and call the references.

8. Clarify the scope of work to be performed and fee(s) charged.

a. Does the scope of work include responding to insurance company questions regarding the scope?

b. If not, how much does the preparer charge to respond to insurance company questions?

c. Is the preparer willing to meet with the adjuster to “defend” his scope against the insurance company’s scope?

9. If the person holds a contractor’s license, check the license status with the Contractors State Licensing Board.

Leave a Reply